HELOC Calculator Walkthrough (Velocity Banking/Accelerated Banking

Velocity Banking Explained How It Works + Should You Do It

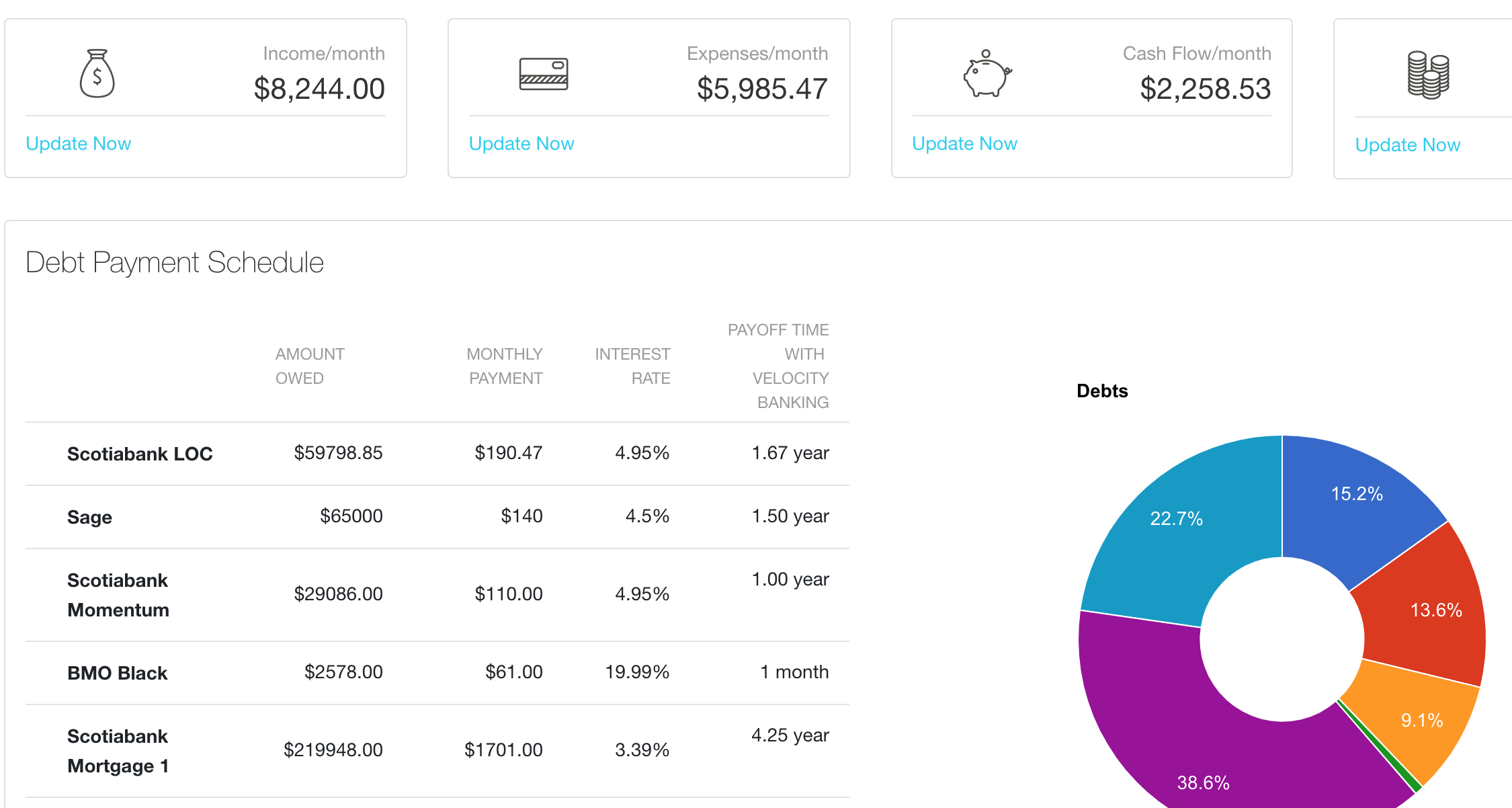

myVelocityBanking runs thousands of calculations to maximize your payments. Find the optimal split for credit card payments, car loans, student loans, and more. Pay-off schedule We show you what to pay and when. It's easy, accurate, and feels like magic. Step-by-step guidance Not sure where to begin? We've got you covered.

velocity Bankingcalculator 2347482457 Banking, Velocity, Calculator

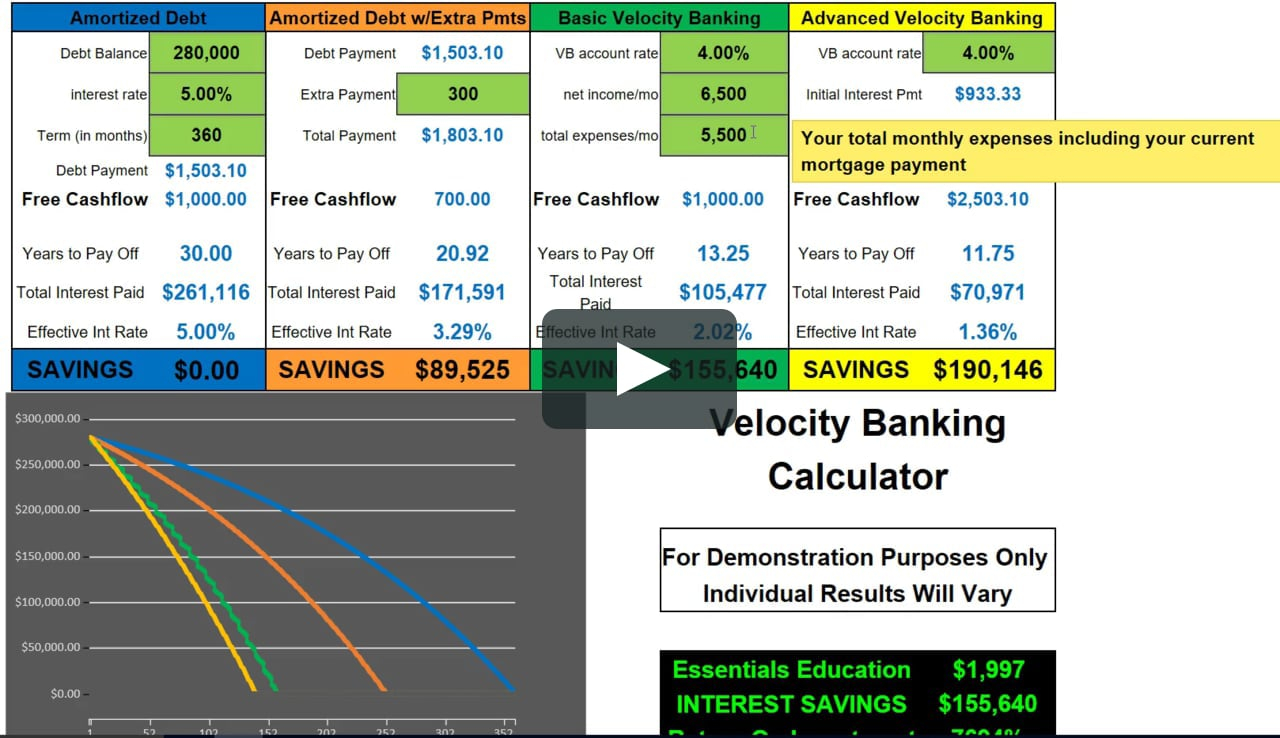

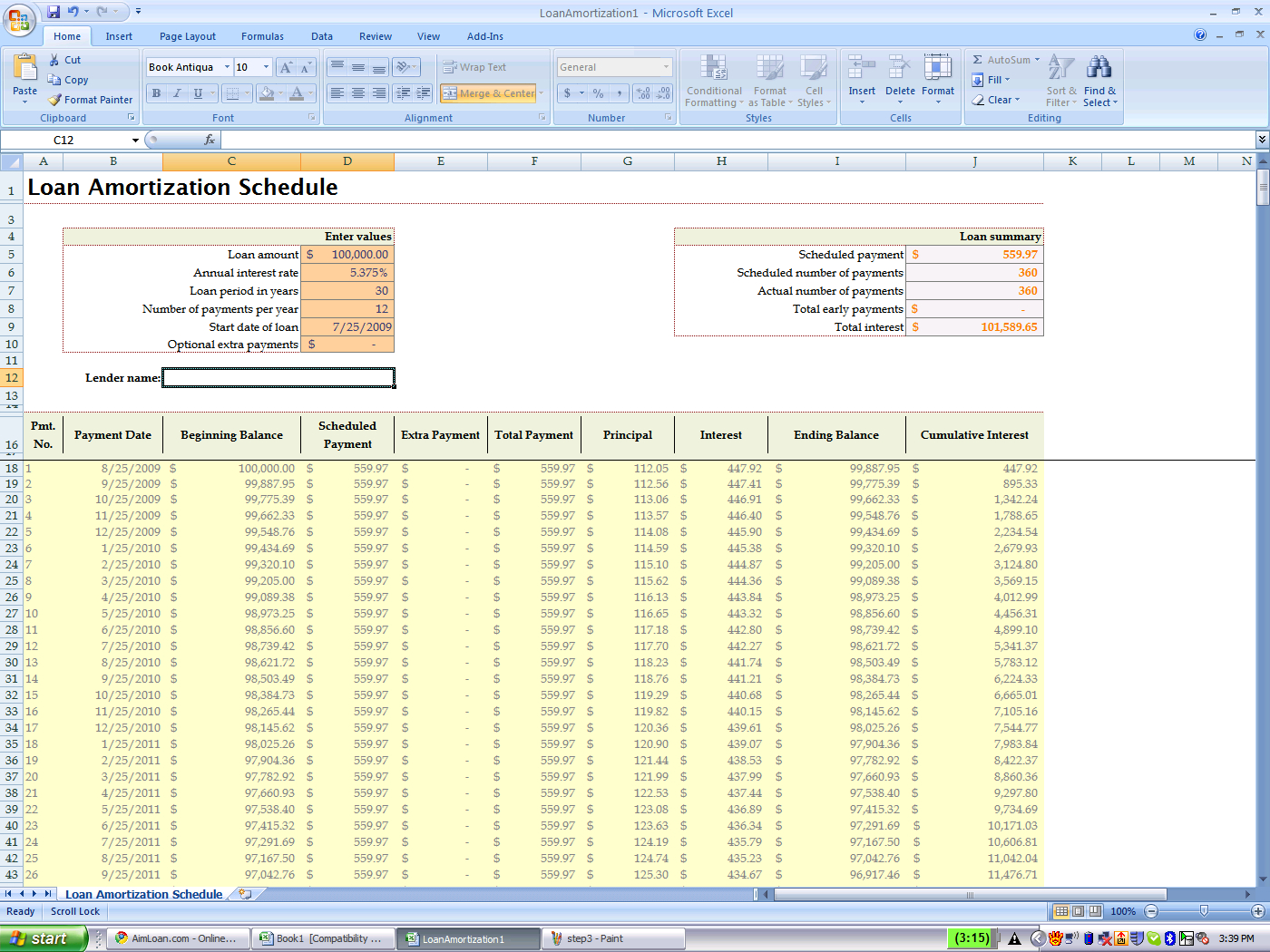

In this video, I will be covering my new velocity banking calculator. This is an online loan amortization calculator that you can use with the velocity banki.

New Velocity Banking Calculator Online Loan Amortization Calculator

You can use a velocity banking calculator to help you pay down your debts more quickly. First, you need to input the balance of each account and the amount of money coming in (either monthly or annually), and then this tool will calculate how long it would take for your debts to become zero. Thanks for visiting.

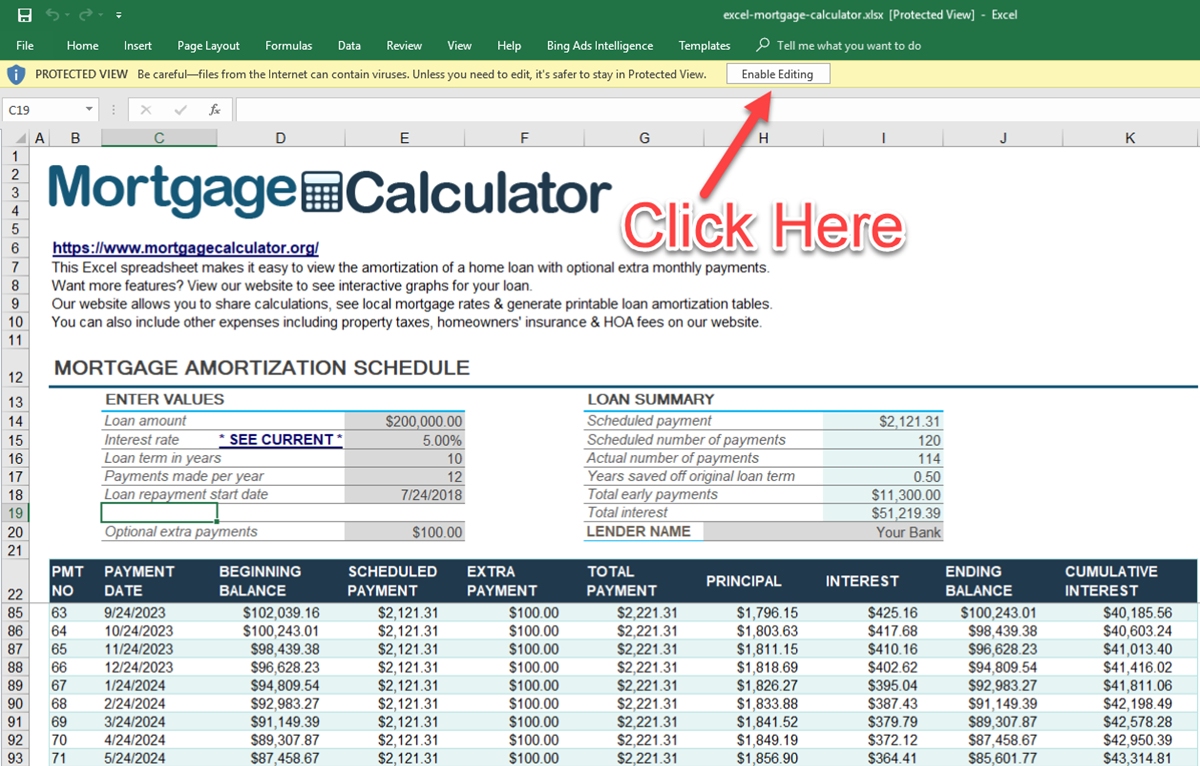

Velocity Banking Spreadsheet Template —

Step 1: Create an Envelope Budgeting System. There are many different ways to budget. In my opinion, the envelope system is the most effective way to budget. You can purchase an envelope budgeting spreadsheet from my Shop, create your own spreadsheet, or find a budgeting app that works for you. Try to find ways to lower costs.

Velocity Banking Spreadsheet Template —

53K subscribers Subscribe 15K views 4 years ago Velocity Banking Training Series In this video, I'll show you how to use Mike's basic loan amortization & payoff calculator. You can download.

HELOC Calculator Walkthrough (Velocity Banking/Accelerated Banking

Discover the power of accelerated payments with the Velocity Banking Calculator. Use the chunking calculator to determine the years of payments you'll save.

Velocity Banking Spreadsheet 1 Google Spreadshee velocity banking

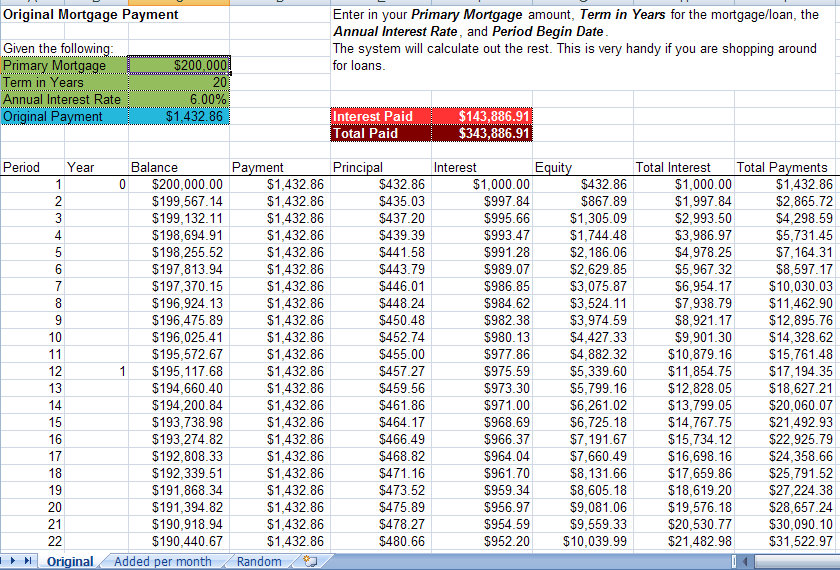

Using a velocity banking calculator, this means your first mortgage payment is around $790 in interest and $162 in principle balance repayment. Common Assumptions of Velocity Banking. The velocity banking method sounds like a simple way to pay off your mortgage quickly. Many people think that velocity banking will help them pay off their.

Velocity Banking Spreadsheet Template —

How Velocity Banking Works Using the velocity banking strategy, you use your HELOC as your checking account. Once open the HELOC, draw almost the entire amount, leaving enough for emergencies if you don't have an emergency fund. Take the draw and put it toward your debt and monthly bills, including your mortgage.

What is Velocity Banking and How Does It Work?

How velocity banking is supposed to work (and what could really happen) Step 1: Take out a mortgage. If you have a $300,000 mortgage with a 30-year payment term and a fixed 3% interest rate, you've agreed to pay your lender $1,265 each month for 360 months. That's adds up to a total of $155,000 in interest if you see the loan through.

Excel Spreadsheet For Velocity Banking Taylor Hicks

Velocity banking, also known as the HELOC strategy or mortgage acceleration strategy, is a financial technique that aims to help homeowners pay off their mortgage faster. It has gained popularity among individuals who want to become mortgage-free sooner and save thousands of dollars in interest payments.

Get My Calculator For Free Click The Link In The Description

Table of Contents What is velocity banking? Velocity banking is a debt payoff method used to accelerate paying down a mortgage or other debts. This strategy typically utilizes a Home Equity Line of Credit (HELOC) to maximize net income and pay down your mortgage debt while minimizing interest costs.

A guide to velocity banking calculator

A velocity banking calculator is a type of useful tool/calculator that can provide you with a virtual board of your financial situation and helps make the right investment decisions. Read more to explore five types of velocity banking calculators. 5 Types of Velocity Banking Calculators Maximum Potential Calculator

Velocity Banking Explained How It Works + Should You Do It

Velocity banking is a personal finance hack that can help you pay off your mortgage fast. We explain what it is and whether it's a good idea.. I used a calculator from the website Truth In Equity, entering these details: $200,000 mortgage balance. Appraised home value of $250,000.

VelocityBanking Free Online Debt Management

This calculator helps you compare a velocity banking strategy rooted in whole life insurance, to the performance of other assets. This can help clients see how using whole life insurance for velocity banking can help them with their long-term financial strategy.

Velocity of Money Formula Calculator (Examples with Excel Template)

It's Easy! Korean Atlanta Mentorship 1.51K subscribers Join Subscribe Subscribed 561 Share Save 19K views 3 months ago Velocity Banking Learn how to create your own Velocity Banking.

Velocity Banking & Calculating Expenses YouTube

What is Velocity Banking? Velocity banking is a strategy that uses a Home Equity Line of Credit (HELOC) to pay off debts instead of the traditional way of paying from monthly income. Experts claim that velocity banking helps you reduce or pay off your debts faster and minimize the interest you pay. Velocity Banking vs. Infinite Banking